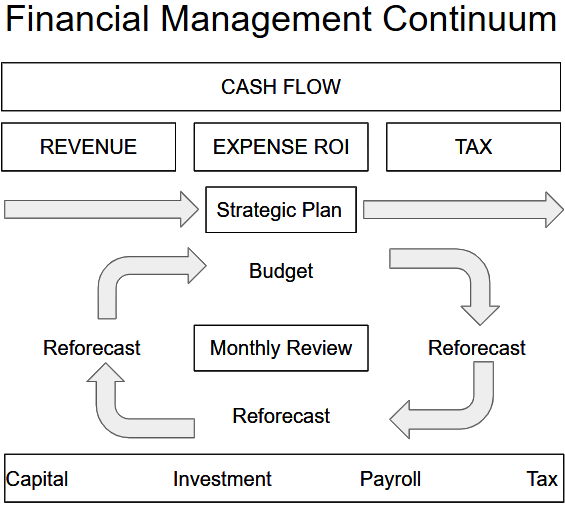

The Financial Management Continuum (FMC) is the term I use to describe the set of processes, components, and cycles that make up a business’s strategic and tactical financial plans. In simpler terms, it’s the process of asking: Where are we financially (e.g., revenue and profit)? Where do we want to go? And what actions and plans will get us there?

Why It Matters

Before diving into the what, why, and how of each process, component, and cycle, it’s important to establish a few key ideas.

The primary goal of the FMC is to maximize the business’s cash flow. But we must also define what kind of cash flow we're trying to maximize. For instance:

Are we focused on maximizing the valuation multiple at exit? If so, we may want to prioritize recurring revenue streams, such as subscriptions or franchise models.

Or are we trying to maximize absolute cash flow? That might involve pursuing different types of revenue altogether.

The FMC is not a theoretical construct designed to overemphasize the role of accounting and finance. Rather, it's a practical framework that supports the business in meaningful, actionable ways:

Fulfillment of Potential – FMC helps the business define what success looks like with the resources it has.

Targets – It establishes clear, measurable financial goals.

Focus – It pinpoints what the business should prioritize—and what it shouldn't.

Feedback – It enables the business to measure progress and identify gaps between current performance and desired outcomes.

Leverage – It helps the business understand its financial mechanics, so it can make adjustments to improve or accelerate results.

As you can see, the FMC and the finance function do far more than just “count the beans.” They help define success, measure where the business stands in relation to that success, and identify where change is needed to reach that success faster.